|

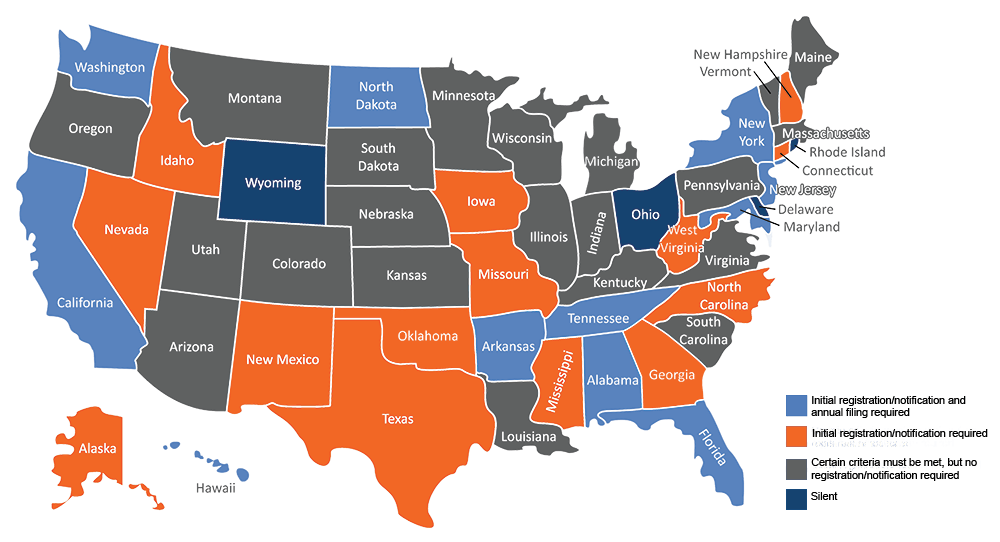

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Code of Alabama Section 8-6-10(8).

- Gift annuity-specific registration - file application with state Securities Commissioner.

- Reserve fund - required.

- Annual reporting - required.

Links to State Regulations Pages

Insurance Department Contact Information

Alabama Securities Commission

445 Dexter Avenue, Suite 12000

Montgomery, AL 36104

or

PO Box 304700

Montgomery, AL 36130-4700

Toll Free: (800) 222-1253

Fax: (334) 242-0240

|

|

Last Updated on Sunday, November 15, 2020 09:38 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Alaska Statutes Section 21.03.070 and 21.03.021.

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $300,000 in unrestricted cash, cash equivalents or publicly traded securities (excluding gift annuity funding assets)

- Notification required

Links to State Regulations Pages

Insurance Department Contact Information

David Phifer

Financial Examiner

Phone: (907) 269-7903

E-mail: [email protected]

Division of Insurance

Robert B. Atwood Building

550 W. 7th Ave., Ste 1560

Anchorage, AK 99501

|

|

Read more...

|

|

State Regulations

|

|

Written by Alicia Gilbert

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Arizona Revised Statutes Section 20-103 and Arizona Revised Statutes Section 20-119.

- Must be a Charitable organization” meaning an entity that is described in § 501(c)(3) or 170(c) of the internal revenue code of 1986.

- Years of operation - three years continuous operation (or successor or affiliate of organization in operation for that time period)

- Minimum assets - $300,000 in unrestricted cash, cash equivalents or publicly traded securities (excludes CGA funding assets)

- Audited financial statements - Must have annual audit of its operations conducted by an independent certified public accountant for the past two fiscal years.

- Commissions not permitted - no compensation to anyone contingent on the donation or amount of the gift annuity (excludes regular compensation paid by the charity to its employees).

Links to State Regulations Pages

|

|

Last Updated on Wednesday, November 11, 2020 06:36 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation:

Issuance of charitable gift annuities is regulated under Arkansas Code Section 23-63-201(d) (enter 23-63-201 in the search box) and Rule 90.

- Years of operation - five years continuous operation (or affiliation with an organization in existence for that time with sufficient management expertise available.

- Gift annuity-specific registration - required

- Reserve fund/investment restrictions - segregated reserve fund required; prudent investor standard

- Annual reporting - required

- Board resolution - required authorizing creation of a gift annuity fund

Links to State Regulations Pages:

Insurance Department Contact Information

Kimberly Johnson, PIR

Insurance Examiner

Finance Division

Arkansas Insurance Department

1 Commerce Way, Suite 505

Little Rock, AR 72202-2087

501-371-2680

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 01:25 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of gift annuities is regulated under California Insurance Code Sections 11520-11524.

- Years of operation – 10 years active operation

- Gift annuity-specific registration – submit detailed application

- Requires a separate trust agreement and shall be legally and physically segregated from other assets of the certificate holder.

- Reserve fund/investment restrictions – segregated reserve fund required; investment restrictions

- Board resolution – required

- Annual and Quarterly reporting - required

Links to State Regulations Pages

Insurance Department Contact Information

Application and Amended Application to Issue Charitable Gift Annuities may now be accepted electronically and are supported by California Department of Insurance's https://interactive.web.insurance.ca.gov/OASIS/front

Please note that if you are submitting by mail, you must file two (2) copies of all the documents listed below and mail to the San Francisco office:

Corporate Affairs Bureau Department of Insurance 1901 Harrison Street, 6th Floor Oakland, CA 94612 Gayle Freidson: 415-538-4418, [email protected]

Monica Macaluso: 415-538-4118, [email protected]

California Department of Insurance (for Annual and Quarterly filings) Financial Analysis Division - Grants & Annuities 300 South Spring Street, South Tower, 13th Floor Los Angeles, CA 90013 (213) 346-6423 Email: [email protected]

|

|

Last Updated on Thursday, January 21, 2021 10:58 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Colorado Revised Statutes 10-1-102(4) and 10-3-903(2)(i) (type in the statute, e.g. 10-1-102, in the search box on the landing page) provide a general exemption from insurance regulation for the issuance of gift annuities which:

- Meet the definition and standards contained in section 501(m)(5) of the federal “Internal Revenue Code of 1986”, as amended; and

- are issued or guaranteed by an organization that at all times during the three years preceding the date of the issuance of such annuity was eligible to receive tax deductible contributions under 170(c).

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 01:29 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Charitable gift annuities are exempt from state insurance regulation under Connecticut General Statutes Sections 38a-1030 to 38a-1034.

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $300,000 in unrestricted cash, cash equivalents or publicly traded securities (excludes counting the annuity gift)

Links to State Regulations Pages

Insurance Department Contact Information

Vanessa Medina

Legal Department

Connecticut Insurance Department

PO Box 816

Hartford, CT 06142-0816

(860) 297-3804

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 01:30 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Delaware Insurance Code Sec. 2902 does provide that annuities subject to insurance regulation exclude those issued by Sec. 501(c)(3) tax-exempt organizations: "An annuity is a contract, issued by a person which is not classified by the Internal Revenue Service as exempt from taxation under Sec. 501(c)(3)." State law does not provide any additional language to specifically address Charitable Gift Annuities. Legal advice is recommended. |

|

Last Updated on Sunday, November 08, 2020 02:33 PM |

|

State Regulations

|

Degree of Regulation

State law does not specifically address Charitable Gift Annuities. Legal advice is recommended. |

|

Last Updated on Sunday, November 08, 2020 02:33 PM |

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Section 627.481 of the Florida Statutes.

A charity must have:

- Years of operation – five years continuous operation;

- Qualified as an exempt organization under the Internal Revenue Code, 26 U.S.C. s. 501(c)(3);

- Reserve fund – segregated reserve fund required;

- Annual reporting – sworn statement required;

- Rates must be calculated to provide 50% of the residuum to charity (ACGA Rates satisfy this).

Links to State Regulations Pages

Insurance Department Contact Information

Florida Office of Insurance Regulation

Hannah Scott

Insurance Analyst

Life and Health Financial Oversight

200 East Gaines Street

Tallahassee, FL 32399-0331

Phone: (850) 413-3140

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:34 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Under Official Code of Georgia Annotated Sections 33-58-1 to 33-58-6, charitable gift annuities are exempt from regulation as an insurance company.

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $300,000 in unrestricted cash, cash equivalents or publicly traded securities, not counting the annuity gift.

- submit an annual filing to the state

Links to State Regulations Pages

Insurance Department Contact Information

Jeremy Betts, J.D.

Director, Captives and Limited Risks

Office of Commissioner John F. King

2 Martin Luther King Jr. Dr

Suite 916 West Tower

Atlanta, Georgia 30334

O: 404-651-6501

C: 470-715-3277

[email protected]

|

|

Last Updated on Tuesday, November 21, 2023 11:35 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Hawaii Revised Statutes Section 431:1-204.

- Minimum assets - $200,000 in cash, cash equivalents or publicly-traded securities in HI.

- In state activity - continuous operation (program services or fundraising activity) in Hawaii for at least 10 years

- Reserve fund – segregated reserve fund required.

Links to State Regulations Pages

Insurance Department Contact Information

Tiffany Zygarewicz

Legal Assistant

State of Hawaii Insurance Division

Department of Commerce and

Consumer Affairs

P.O. Box 3614

Honolulu, HI 96811

Phone: (808) 586-2790

E-mail: [email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:36 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Under Idaho Code Sections 41-114 and 41-120, issuers of qualified charitable gift annuities are exempt from complying with the Idaho Insurance Code.

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $100,000 in available unrestricted assets (cash, cash equivalents or publicly traded securities exclusive of the assets funding the annuity agreement and adjusted for inflation).

Links to State Regulations Pages

Insurance Department Contact Information

Carol Anderson

Examinations Section

Idaho Department of Insurance

700 West State Street

P.O. Box 83720

Boise, ID 83720-0043

Phone: (208) 334-4309

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:37 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Under Section 215 ILCS 5/121-2.10, issuance of charitable gift annuities is exempt from insurance regulation.

- Years of operation - 20 years continuous operation

- Minimum assets - $2 million unrestricted fund balance. Assets restricted to uses inconsistent with the payment of annuity obligations cannot be counted toward meeting the fund balance requirement.

- Reinsurance permitted - the two requirements above are waived if the annuity agreements are reinsured with a commercial insurance company registered to do business in Illinois.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:38 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Indiana Code Section 27-1-12.4-2 exempts charitable gift annuities from regulation by the Department of Insurance.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:39 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Gift annuities are regulated under State of Iowa Laws Section 508F.1 through 508F.8.

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - the lesser of $300,000 or five times the face value of total outstanding gift annuities in unrestricted cash, cash equivalents or publicly traded securities, not including the gift annuity funding assets

Links to State Regulations Pages

Insurance Department Contact Information

Wayne Lacher

Compliance officer II

Iowa Insurance Division

1963 Bell Avenue

Des Moines, IA 50315

Phone: 515-654-6571

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:39 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is exempt under Kansas Uniform Securities Act, Section 17-12a201(7).

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:40 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Under Section 304.1-120 of the Kentucky Revised Statutes, charitable gift annuities are exempt from insurance regulation.

- An organization exempt from federal income tax and file a Form 990 (unless a Sec. 501(c)(3) religious organization)

- Or a publicly owned or nonprofit privately endowed educational institution approved or licensed by the Kentucky Board of Education, the Southern Association of Colleges and Schools or the equivalent

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:41 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Charitable gift annuities are exempt from regulation by the Louisiana Insurance Code under Secs. 22:951(D) and 22:952 of the Louisiana Revised Statutes.

- Organization exempt from federal income tax – are also exempt from Louisiana Insurance Regulations

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:41 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Maine Insurance Code, Title 24-A, Section 3 and Section 703-A.

- An organization exempt from federal income tax

- Years of operation - five years (or be a successor to a qualifying organization such that the combined operating years of the two organizations is at least five years)

- Incorporated in Maine or qualified foreign corporation

- Registration w/ other state agency - the foreign corporation must file with Secretary of State.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 15, 2020 09:18 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Maryland Insurance Code Sec. 16-114.

- In-state activity - charity must provide proof of activity in the state for 10 years

- Reserve fund - segregated reserve fund required; prudent investor rule

Links to State Regulations Pages

Insurance Department Contact Information

Director - Life, Annuity and Credit

Maryland Insurance Administration

200 St. Paul Place, Suite 2700

Baltimore, MD 21202-2004

Phone: (410) 468-2170

NOTE: Please be advised that Maryland has clarified the attestation requirement for permit holders. This clarification confirms that either a statement must be included in the filing, or a separate letter must be filed and states the reserves meet the state requirements and are held in a segregated account. Although this has always been part of the statute, Maryland recently sent communications clarifying this requirement. Charities registered in Maryland should ensure their filings meet these requirements.

|

|

Last Updated on Wednesday, December 28, 2022 04:08 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Charitable gift annuities are exempt from regulation by the Massachusetts Insurance Code under Chapter 175, Sec. 118 of the General Laws of Massachusetts

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:43 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Michigan Code does not address the exemption of charitable gift annuities from insurance regulation. However, Attorney General Opinion (Opinion No. 6538) held that a gift annuity program proposed by the Michigan State University Foundation was not subject to regulation under the Insurance Code. In addition, the Attorney General stated that regulation would not be imposed unless the issuance of annuities became the chief purpose of the foundation. The office of the Commissioner of Insurance views the opinion as applying to any legitimate charity.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:44 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Minnesota Securities Statute 80A.45 Section 201(7).

- Not for profit, operated exclusively for religious, educational, etc. purpose

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:44 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Charitable Gift Annuities are exempt from insurance regulation under Mississippi Code Sections 79-11-651 through 79-11-661.

- Years of operation - three years of continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $300,000 in unrestricted cash, cash equivalents or publicly traded securities, exclusive of the assets funding the gift annuity agreement.

- Be registered for charitable solicitation with the Mississippi Secretary of State (unless exempt from such registration).

Links to State Regulations Pages

Insurance Department Contact Information

Tanya Webber

Assistant Secretary of State for Charities

Charities Division

Mississippi Secretary of State

P.O. Box 136

Jackson, MS 39205

(601) 359-1599

|

|

Last Updated on Sunday, November 08, 2020 02:45 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Charitable gift annuities are exempt from insurance regulation by the State of Missouri Laws Sections 352.500 - 352.520

- Years of operation – three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $100,000 in unrestricted cash, cash equivalents or publicly traded securities (exclusive of the assets funding the annuity agreement).

- Organization exempt from federal income tax

Links to State Regulations Pages

Insurance Department Contact Information

Kelly Hopper

Chief of Regulatory Operations

Insurance Company Regulation Division

Missouri Department of Commerce & Insurance

301 W High Street, Suite 530

P.O. Box 690

Jefferson City MO 65102

573-751-2711

[email protected]

|

|

Last Updated on Wednesday, October 18, 2023 10:01 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Gift Annuities are exempted from state regulation under Montana Code Annotated, Sections 33-20-701 through 33-20-702

- Years of operation - three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

- Minimum assets - $300,000 in net worth or at least $100,000 in unrestricted cash, cash equivalents or marketable securities, exclusive of the assets funding the gift annuity agreement.

- Reserve fund - segregated reserve required.

- Reinsurance permitted - the above requirements are waived if the charity commercially reinsures its gift annuities by a licensed insurance company qualified to do business in Montana.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:46 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Nebraska’s Charitable Gift Annuity Act, Revised Statutes of Nebraska, Sections 59-1801 to 59-1803.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirement:

- have been in continuous operation for at least three years.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:47 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Nevada Revised Statutes, Sections 688A.281 through 688A.285.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have at least $300,000 in unrestricted cash, cash equivalents or publicly traded securities, not counting the assets transferred for the annuity gift

- provide notice to the Division of Insurance

- not pay compensation that is contingent upon the issuance of the annuity or based upon the value of the annuity, other than a payment for reinsurance to an insurer licensed to issue insurance in Nevada (the definition of a qualified gift annuity specifically excludes an annuity for which a commission is paid)

Links to State Regulations Pages

State Contact

Jack Childress Insurance Actuarial Analyst III Nevada Division of Insurance [email protected]Michael Ponce Insurance Actuarial Analyst I Nevada Division of Insurance [email protected]** As of February 26, 2016, filings are only being accepted via email.

[email protected]

|

|

Last Updated on Monday, September 11, 2023 04:28 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Chapter 403-E of New Hampshire Revised Statutes Annotated.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have at least $300,000 in unrestricted cash, cash equivalents or publicly traded securities, not counting the assets transferred for the annuity gift

- provide notice to the New Hampshire Department of Justice

- maintain gift annuity reserves, invested in accordance with the prudent investor standard

- submit an annual filing to the state

- be registered as a charitable organization with the New Hampshire Department of Justice (unless exempt from such registration)

- offer annuity rates that do not exceed the rates suggested by the ACGA at the time the annuity is issued

Links to State Regulations Pages

Department of Justice Contact

Audrey Blodgett

New Hampshire Department of Justice

Charitable Trusts Unit

33 Capitol Street

Concord, NH 03301

(603) 271-3591

[email protected]

|

|

Last Updated on Tuesday, December 15, 2020 06:20 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under New Jersey State Statutes Annotated Section 17B:17-13.1.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least ten years

- obtain a permit from the Department of Banking and Insurance

- maintain gift annuity reserves, invested in accordance with the prudent investor standard

- submit an annual filing to the state

- adopt a board resolution referencing applicable state statutory provisions

- be registered for charitable solicitation with the New Jersey Department of Law and Public Safety and to do business in the state with the New Jersey Division of Revenue (unless exempt from such registrations)

Links to State Regulations Pages

New Jersey Insurance Department Contact Information

June A. Duggan

Department of Banking & Insurance

Office of Solvency Regulation

8th Floor

20 West State Street

P.O. Box 325

Trenton, NJ 08625-0325

phone: 609-292-5350 ext. 50326

e-mail: [email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:48 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under New Mexico Statutes Annotated, Section 59A-1-16.1.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have a fund balance (assets in excess of liabilities) of at least $300,000, or unencumbered assets in its gift annuity fund (not counting reserves) of at least $300,000

- provide notice to the Insurance Division

Links to State Regulations Pages

Public regulation Commission Contact

Viara Ianakieva

Staff Manager

Life and Health Rate & Form Filing Bureau

Office of Superintendent of Insurance

P.O. Box 1689

Santa Fe, NM 87504-1689

(505) 508-9073

[email protected]

|

|

Last Updated on Tuesday, December 15, 2020 06:24 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under New York State Insurance Law Section 1110

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least ten years

- obtain a permit from the Insurance Department

- maintain gift annuity reserves, invested in accordance with the prudent investor standard

- submit an annual filing to the state

- adopt a board resolution referencing applicable state statutory provisions

Links to State Regulations Pages

Additional Information

- As of January 5th, the New York Department of Financial Services have posted their maximum allowed rates for Charitable Gift Annuities. NY is using a return assumption of 5%. As the new ACGA rates use an assumption of 4.25%, the newly released ACGA rates are lower than the maximum rates allowed by NY. This means charities in NY, and those registered in NY, can continue to use the suggested maximum ACGA rates for single and joint CGA gifts and remain in compliance with NY regulations. The ACGA continues to work directly with NY to update the statutes to avoid this conflict in the future.

- The American Council on Gift Annuities (ACGA) is pleased to share our progress in working with regulators in New York State regarding maximum allowable charitable gift annuity payout rates. For more information on the background and the solution we are working on with The New York Department of Financial Services, please click here.

- ACGA Collaborates with New York Insurance Department to Reach Compromise on New Reserve Requirements for Charities That Issue Gift Annuities in New York - Click Here

- Further clarification on calculating required assets in the case of a charity that applies for a certificate of exemption rather than a permit in New York - Click Here

New York Insurance Department Contact Information

David Hee

Supervising Insurance Examiner

Life Bureau Department of Financial Services

One State Street, 11th Floor

New York, NY 10004-1511

[email protected]

https://www.dfs.ny.gov/insurance/life/charanlc.htm

IRA QCDs Update

Click here to read more bout how QCD's funded with IRAs should be handled.

|

|

Last Updated on Monday, March 27, 2023 01:07 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under General Statutes of North Carolina Section 58-3-6.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have at least $100,000 in unrestricted cash, cash equivalents or publicly traded securities, exclusive of the assets contributed by the donor for the annuity agreement.

- provide notice to the Department of Insurance

Links to State Regulations Pages

Department of Insurance Contact

Cara Shackelford Senior Policy and Rate Analyst

Life & Health Division

North Carolina Department of Insurance

1201 Mail Services Center

Raleigh, NC 27699-1201

(919) 807-6064

|

|

Last Updated on Sunday, November 15, 2020 09:23 AM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under the State Century Code Sections 26.1-34.1-01.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- apply for a certificate of exemption from the Insurance Department

- maintain gift annuity reserves

- submit an annual filing to the state

Links to State Regulations

North Dakota Insurance Department Contact Information

Patrick Hendrickson

Financial Analyst

North Dakota Insurance Department

600 E Boulevard Ave.

Bismarck, ND 58505-0320

[email protected]

|

|

Last Updated on Tuesday, December 15, 2020 06:29 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Ohio law does not specifically address charitable gift annuities. In one case, Transgenstein v. Board of Trustees of Wheaton College, 96 Ohio St. 3d 1525 (2002), the appellate court found that gift annuities do not constitute “transacting the business of life insurance” in the Ohio. Because no further guidance is available, legal advice is recommended for the issuance of gift annuities in this state. |

|

Last Updated on Sunday, November 08, 2020 02:51 PM |

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under the Oklahoma Charitable Gift Annuity Act (Oklahoma Statutes, Title 36, Sections 4071-4082).

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have a minimum of $100,000 in unrestricted assets, not including assets comprising the annuities

- provide notice to the Department of Insurance

- submit an annual filing to the state

- be qualified to do business in the state, which may necessitate registration with the Secretary of State (unless exempt from such registration)

Links to State Regulations

Department of Insurance Contact Information

Department of Insurance

Dana Morphew

RIS Specialist II

400 NE 50th Street

Oklahoma City, OK 73105

(405) 522-8398

[email protected]

|

|

Last Updated on Tuesday, October 17, 2023 01:15 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Oregon Revised Statutes 731.038.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least five years (or be the successor or affiliate of an organization in operation for that period of time)

- have a minimum of $300,000 in net assets as shown by an annual audited financial statement by an independent certified public accountant (CPA);

- maintain gift annuity reserves invested in accordance with the prudent investor standard

A charity that held a certificate of authority from the Oregon Insurance Department under the state’s prior gift annuity law (which was in effect through December 31, 2005) may continue to issue annuity agreements, even if it does NOT have $300,000 in net assets or has been in continuous operation for five years.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:52 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Pennsylvania Statutes, Title 10, Sections 361-364.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in operation for at least three years (or be the successor or affiliate of an organization in operation for that period of time)

- have unrestricted assets of at least $100,000

- maintain gift annuity reserves

- be registered for charitable solicitation with the Pennsylvania Department of State (unless exempt from such registration; see paragraph 6, option 3 in the disclosure language below)

|

|

Last Updated on Sunday, November 08, 2020 02:53 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

State law does not specifically address Charitable Gift Annuities. Legal advice is recommended. |

|

Last Updated on Sunday, November 08, 2020 02:54 PM |

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Section 38-5-20 of the Code of Laws of South Carolina.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirement:

- have been in active operation for at least five years

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:54 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under South Dakota Codified Laws Section 58-1-16.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least 10 years

- have at least $500,000 in unrestricted cash, cash equivalents or publicly traded securities, exclusive of the assets funding the annuity agreement as of the date of the annuity agreement

- be a qualified organization (a qualified organization means an organization which is either domiciled in South Dakota and has its principal place of business in South Dakota or is qualified to do business in South Dakota as a foreign corporation, and which is exempt from taxation under Section 501(c)(3) of the Internal Revenue Code as a charitable organization and regularly files a copy of Federal Form 990 in the Office of the Attorney General or is exempt from taxation under Section 501(c)(3) of the Intern Revenue Code as a religious organization or is exempt as a publicly owned or nonprofit, privately endowed educational institution approved, accredited, or licensed by the state board of education, the north central association of colleges and schools, or an equivalent public authority of the jurisdiction where the institution is located.)

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:55 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Tennessee Code Annotated, Sections 56-52-101 through 56-52-111.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- obtain a certificate of authority from the Tennessee Insurance Department

- maintain gift annuity reserves, invested in accordance with the prudent investor standard

- submit an annual filing to the state

Links to State Regulations Pages

Insurance Department Contact Information

Michael Landers

Company Licensing Analyst

Tennessee Insurance Division

Davy Crockett Tower, 7th Floor

500 James Robertson Parkway

Nashville, TN 37243

p. 615-741-7346

f. 615-532-2788

[email protected]

|

|

Last Updated on Tuesday, December 15, 2020 06:38 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Chapter 102, Texas Insurance Code.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for more than three years

- have a minimum of $100,000 in cash, cash equivalents, or publicly-traded securities, exclusive of assets funding the annuity agreements

- provide notice to the Department of Insurance

Links to State Regulations

Department of Insurance Contact Information

Life/Health and HMO Intake Team

Life, Annuity and Credit Program

Life and Health Lines Office

Texas Department of Insurance

MC-106-1A

P.O. Box 149104

Austin, TX 78714-9104

(512) 676-6628

Email: [email protected]

NOTE: Filing may be submitted via email.

|

|

Last Updated on Tuesday, December 15, 2020 06:41 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Utah Code Annotated Sections 31A-1-301(88) and (93) and 31A-22-1305.

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:56 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Vermont Statutes Title 9, Chapter 68, Sections 2517 to 2518.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for three years (or be the successor or affiliate of an organization in operation for that period of time)

- have at least $300,000 in unrestricted cash, cash equivalents or publicly traded securities, in addition to the assets necessary to fund the charity's outstanding annuity obligations on the date it enters into a gift annuity agreement

Links to State Regulations Pages

|

|

Last Updated on Thursday, March 10, 2022 05:21 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Sections 38.2-106.1 and 38.2-3113.2 of the Code of Virginia.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years

- have at least $100,000 in cash, cash equivalents, or publicly-traded securities, not including the assets contributed for annuities

Links to State Regulations Pages

|

|

Last Updated on Sunday, November 08, 2020 02:57 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under Revised Code of Washington Chapter 48.38 and Chapter 284-38 WAC In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for three years

- have $500,000 in unrestricted net assets

- obtain a certificate of exemption from the Office of Insurance Commissioner.

- maintain gift annuity reserves, invested in accordance with the prudent investor standard

- submit an annual filing to the state

- register as a charitable organization with the Washington Secretary of State (unless exempt from such registration)

Links to State Regulations

Washington Insurance Department Contact Information

For Registration and Financial Filings:

Office of the Insurance Commissioner

Company Supervision Division

P.O. Box 40255

Olympia, WA 98504-0255

[email protected]

(360) 725-7200

For Form Filings:

Office of the Insurance Commissioner

Rates and Forms Division

P.O. Box 40255

Olympia, WA 98504-0255

(360) 725-7111

|

|

Last Updated on Sunday, November 08, 2020 02:58 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Issuance of charitable gift annuities is regulated under West Virginia Code Section 33-13B-1-6.

In order to issue gift annuities in the state, a charity must meet the following regulatory requirements:

- have been in continuous operation for at least three years (or be a successor or affiliate of a charitable organization that has been in continuous operation for three years).

- have a minimum of $300,000 in unrestricted cash, cash equivalents, or publicly-traded securities, exclusive of the assets funding the annuity agreements

- provide notice to the Office of the Insurance Commissioner

Links to State Regulations Pages

West Virginia Insurance Department Contact Information

Cristy Dunlap, CAP, MOS

Data Analyst I

WV Offices of the Insurance Commissioner

Financial Conditions Division

PO Box 50540

Charleston, WV 25305-0540

(304) 558-2100

[email protected]

|

|

Last Updated on Tuesday, December 15, 2020 06:43 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

Effective April 18, 2014, a significant change has occurred in the law governing issuance of charitable gift annuities in Wisconsin. (2013 Wisconsin Act 271) Previously a highly regulated state, requiring application to the Office of the Commissioner of Insurance (OCI) and annual reporting, Wisconsin now provides gift annuities with a general exemption from insurance regulation, with no filing required (either initially or annually) to the OCI.

- Years of operation – three years continuous operation (or be the successor or affiliate of an organization in operation for that period of time)

Links to State Regulations Pages

Wisconsin Insurance Department Contact Information

Bureau of Financial Analysis and Examinations

Office of the Commissioner of Insurance

P.O. Box 7873

Madison, WI 53707-7873

Kristin Forsberg

(800) 236-8517

[email protected]

OR

Steve Caughill

(608) 267-2049

[email protected]

|

|

Last Updated on Sunday, November 08, 2020 02:59 PM |

|

Read more...

|

|

State Regulations

|

Degree of Regulation

State law does not specifically address charitable gift annuities. Legal advice is recommended. |

|

Last Updated on Sunday, November 08, 2020 02:59 PM |

|

|